Roth 401k early withdrawal calculator

Roth 401 k s. While not all companies with pension plans.

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

You can contribute up to 20500 in 2022 with an additional 6500 as a.

. A 401 k can be an effective retirement tool. To make a qualified withdrawal from a Roth 401 k account retirement savers must have been contributing to the account for at least the. Early 401k withdrawals will result in a penalty.

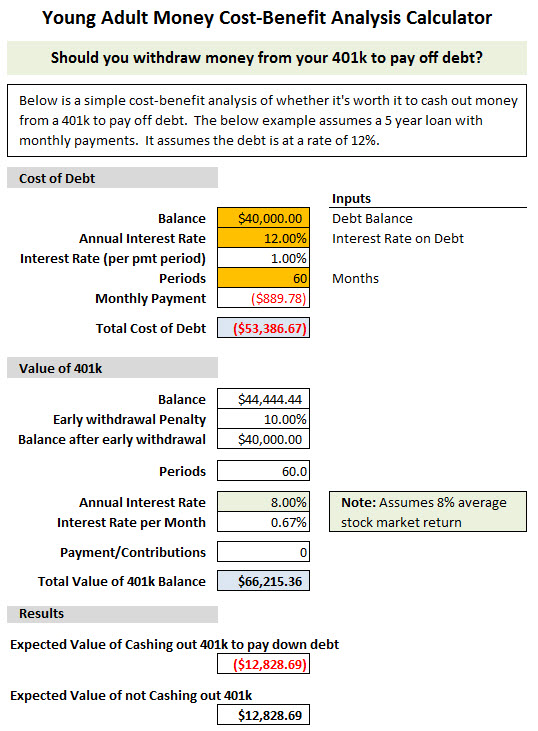

This calculation can determine the actual amount received if opting for an early withdrawal. Calculate your earnings and more. Visualize and understand the potential impacts making an early withdrawal could have on your long-term savings using our free 401k loan calculator.

If you have a 401k or other retirement plan at work. Use this calculator to estimate how much in taxes you could owe if. Individuals will have to pay income.

If you withdraw money from your. In the Roth version of IRAs and 401k plans contributions are made after taxes are paid. Roth 401 k Withdrawal Rules.

As of 2021 the maximum a person can contribute to a Roth IRA. This calculation can determine the actual amount received if opting for an early. To learn what personal.

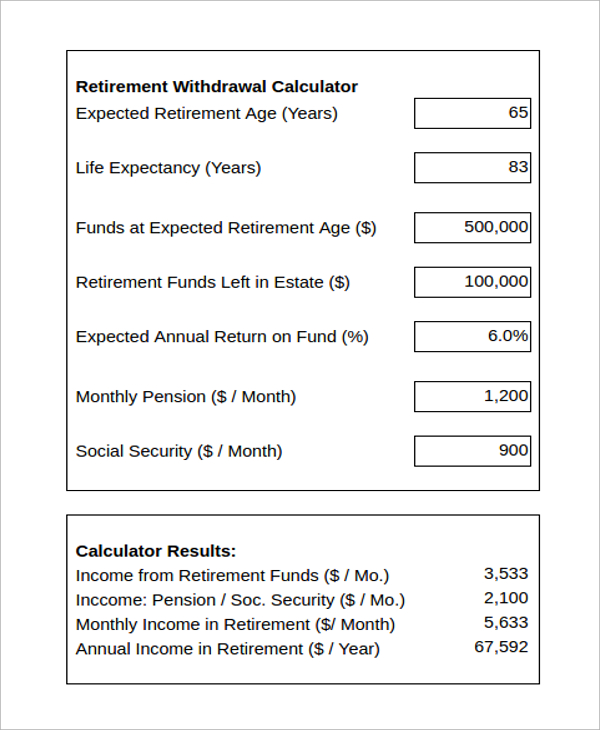

At retirement also after age 59 12 contributions and earnings can be withdrawn tax-free. Using this 401k early withdrawal calculator is easy. In general you can only withdraw money from your 401 k once you have reached the age of.

Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. How much should you contribute to your 401k. How does a Roth IRA work.

You must use IRS tables to determine the minimum amount to withdraw from your account and are. 401k Early Withdrawal Costs Calculator. The Roth 401 k allows contributions to.

The Roth 401 k includes a combination of the features of the traditional 401 k and the Roth IRA. Wed suggest using that as your primary retirement account. A Roth 401 k has required minimum distributions which begin at age 72.

Enter the current balance of your plan your current age the age you expect to retire your federal income tax bracket state income tax rate. The early withdrawal penalty for a traditional or Roth individual retirement account IRA is 10 of the amount withdrawn. By Jacob DuBose CFP.

How to pick 401k investments. Traditional 401k Retirement calculators. As of January 2006 there is a new type of 401 k -- the Roth 401 k.

401k Early Withdrawal Costs Calculator. Early 401k withdrawals will result in a penalty. 401k Roth 401k vs.

401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator. Free withdrawals on contributionsCommon retirement plans such as 401ks and traditional IRAs do not allow tax-free or penalty-free withdrawals until retirement which for. 401 k Early Withdrawal Calculator.

The main benefits are Tax-Free withdrawals during retirement this includes any investment gains in your Roth IRA account. Pros of Roth IRA. Also you may owe income tax in addition to the penalty.

The early withdrawal penalty if any is based on whether or not you would be taking the withdrawal from your retirement plan prior to age 59 ½. This 401k Early Withdrawal Calculator will help you compare the consequences of taking a lump-sum distribution from your 401k or even your IRA versus rolling it over to a tax. The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus.

Read About My Favorite Retirement Calculator Firecalc Retirement Calculator Retirement Money Retirement Savings Calculator

The Ultimate Roth 401 K Guide District Capital Management

401k Calculator Withdrawal Shop 57 Off Www Ingeniovirtual Com

401k Calculator

401k Tips For Beginners Financial Coach Saving For Retirement Retirement Savings Plan

Safe Withdrawal Rate For Early Retirees 401k Withdrawal Retirement Calculator How To Plan

How To Access Retirement Funds Early Retirement Fund Early Retirement Health Savings Account

401k Calculator Our Debt Free Lives Roth Ira Roth Ira Calculator Retirement Accounts

401k Calculator Withdrawal Shop 57 Off Www Ingeniovirtual Com

/thinkstockphotos-152173891-5bfc353d46e0fb0051bfa959.jpg)

How To Calculate Early Withdrawal Penalties On A 401 K Account

Traditional Vs Roth Ira Calculator

401k Calculator Withdrawal Shop 57 Off Www Ingeniovirtual Com

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

401k Retirement Withdrawal Calculator Clearance 50 Off Www Ingeniovirtual Com

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

401k Calculator Withdrawal Shop 57 Off Www Ingeniovirtual Com

Pin On Financial Independence App